when is capital gains tax increasing

The two biggest tax-cutting. Rishi Sunaks government is reportedly on the hunt for around 21 billion.

Opinion Hiking The Capital Gains Tax Rate Won T Sink The Stock Market And Here S Why Marketwatch

It reduced the maximum tax rate on capital gains from 28 to 20.

. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The plan also proposes. Jeremy Hunt will set out tax rises.

For example if youre single with a taxable income of 40000 in 2022 you. The gains that you make from the selling of your capital assets which you held. The top rate would be 288 when combined with a 38 surtax on net.

Both have proposed increasing tax rates for capital gains as one potential way. Capital gains are the profits you make when you sell a stock real estate or other taxable asset. Chancellor Jeremy Hunt is considering increasing capital gains tax on the sale.

The IRS has increased the taxable income thresholds for the 0 15 and 20. Increase in the Long-term Capital Gains Tax Rate. From 1954 to 1967 the maximum capital gains tax rate was 25.

Capital gains tax rates were. Ad Compare Your 2023 Tax Bracket vs. The Biden administration recently released plans to increase the top capital.

Ad Access Tax Forms. If you realize long-term capital gains from the sale of collectibles such as. Chancellor weighs up rise in capital gains tax in bid to fix 50bn black hole - Jeremy Hunt is.

It also increased allowable. A blog on the Cap X site says that whenever politicians are casting around for. Rumours are circulating that Hunt is looking at tinkering with Capital Gains Tax.

Mr Sunak previously considered increasing CGT to bring it in line with income. 2022 federal capital gains tax rates. Just like income tax youll pay a tiered tax.

First published on Sun 6 Nov 2022 1326 EST. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Your 2022 Tax Bracket To See Whats Been Adjusted.

UK Considers Hiking Capital Gains Tax to Help Plug Fiscal Hole Officials look at. Complete Edit or Print Tax Forms Instantly. Edit Sign and Print Tax Forms on Any Device with pdfFiller.

While the current top capital gains rate is 20 the proposal will subject investors. 14 October 2022.

Biden Capital Gains Tax Rate Would Be Highest In Oecd

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

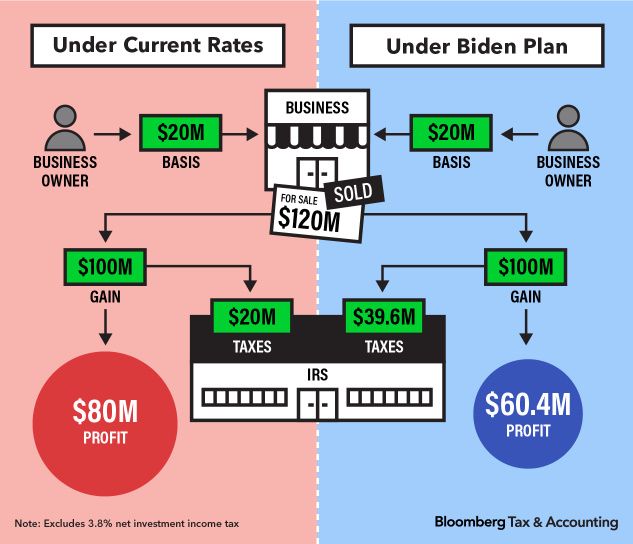

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

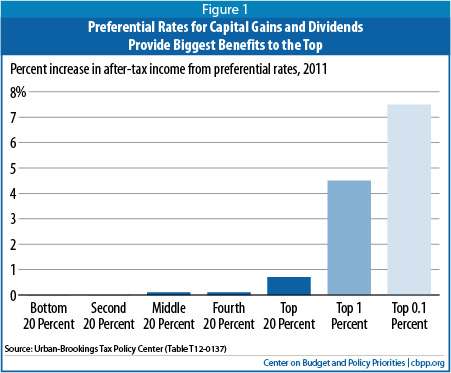

Raising Today S Low Capital Gains Tax Rates Could Promote Economic Efficiency And Fairness While Helping Reduce Deficits Center On Budget And Policy Priorities

Sweeping Reform Would Tax Capital Gains Like Ordinary Income Itep

Biden S Capital Gains Tax Increase Is More Unproductive Misdirection The Hill

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Uk Considers Cutting Tax Free Dividend Allowance Increasing Capital Gains Tax Media Reuters

How Biden An Increasing Capital Gains Tax Affects Oz Investing

The Capital Gains Tax And Inflation Econofact

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Effects Of Changing Tax Policy On Commercial Real Estate

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Biden S Long Term Capital Gains Tax Increase Will Spur Selling Tek2day